Profit Participation Units: What Australian Tech Professionals Need to Know

- Mo Shouman

- Jan 22

- 6 min read

By Mo, Founder and Principal Adviser – My Wealth Choice, Sydney

OpenAI just opened an office in Sydney.

They're hiring aggressively. Senior engineers, product leads, researchers. The comp packages look incredible on paper.

But buried in those offer letters is something most Australian tech professionals have never seen before: Profit Participation Units.

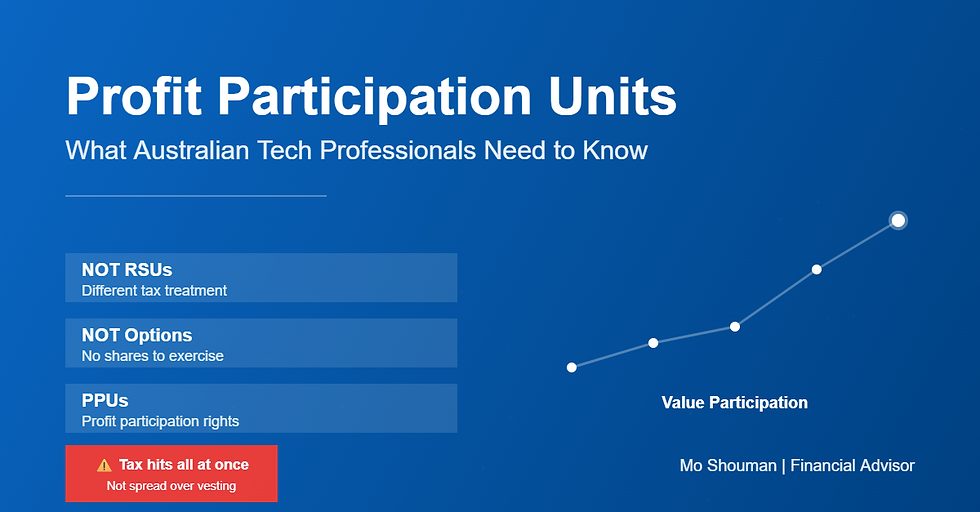

Not RSUs. Not options. PPUs.

And if you don't understand what you're signing, you could be walking into a tax structure that costs you hundreds of thousands down the line.

Let me explain what these are, why they matter, and what you need to know before you say yes.

What Are Profit Participation Units?

PPUs are a form of equity compensation that gives you a share in the company's profits and growth in value.

Think of them as a hybrid. They're not shares you own outright. They're not options you exercise. They're a contractual right to participate in the company's success.

Here's how they work:

You're granted PPUs with a strike price (usually the fair market value at grant date). As the company grows, you participate in the increase in value above that strike price. When there's a liquidity event—acquisition, IPO, secondary sale—you get paid the difference.

No upfront cost. No shares changing hands. Just a claim on future value.

Sounds clean, right?

It is. Until you look at the Australian tax treatment.

How PPUs Differ From RSUs and Options

Most tech professionals in Australia are used to RSUs or stock options from companies like Google, Meta, Atlassian, Canva.

RSUs are simple. Shares vest, you're taxed on the market value as ordinary income, done. You own the shares. You sell them when you want (or hold them and cop the concentration risk, but that's another conversation).

Options give you the right to buy shares at a set price. You exercise, pay tax on the spread, then decide when to sell.

PPUs are different.

You don't own shares. You don't exercise anything. You're entitled to value, not equity. And that creates a tax treatment most advisors—and most employees—completely miss.

Here's the kicker: in Australia, PPUs are generally taxed as ordinary income when they pay out, not when they vest.

That means if you stay at OpenAI for four years, your PPUs vest annually, but you won't see a cent—or pay a cent of tax—until there's a liquidity event.

Could be two years. Could be ten.

And when that event happens? You're hit with the full tax bill in one financial year.

No shares to sell incrementally. No way to stage the income. Just a massive lump sum that could push you into the top marginal tax bracket and cost you 47% plus Medicare Levy.

The Tax Traps You Need to Watch

Here's where it gets messy.

Phantom Income Risk

If the PPUs pay out but you've already left the company, you could owe tax on income you received years after your employment ended.

Your cash flow planning just became a minefield.

Timing Mismatch

Let's say OpenAI goes public in 2027. You joined in 2025. Your PPUs are worth $800,000 at IPO.

That's $800,000 of assessable income. In one year.

If you're already earning $350,000 in salary, you're now sitting on $1.15 million of taxable income.

The ATO wants $376,000 in tax (roughly).

Do you have that sitting in your offset account? Or did you assume the tax would be spread over four years like RSUs?

No Withholding at Source

With RSUs, your employer withholds tax when the shares vest. You see the net amount hit your brokerage account.

With PPUs, there's no withholding. The company pays you the full value. You owe the ATO. And if you haven't planned for it, you're scrambling in July to find six figures in cash.

Concentration Risk on Steroids

PPUs concentrate your wealth in one private company with no secondary market.

You can't sell down. You can't diversify. You're locked in until liquidity.

And if that liquidity event doesn't happen? Or happens at a lower valuation than expected? You've deferred income, taken career risk, and built your financial plan around a number that evaporated.

I've seen this play out with clients who joined startups in 2021. Valuations were sky-high. PPU packages looked life-changing on paper.

Then the market turned. The IPO got delayed. The company did a down round.

Suddenly those PPUs are worth 40% of the original projection. Or nothing.

The Opportunity: Structure It Right From Day One

Here's the thing: PPUs aren't bad.

They're just misunderstood.

If you know what you're dealing with, you can build a strategy around them that most people miss.

1. Model the Tax Impact Before You Sign

Don't just look at the headline number. Model the tax.

What's the after-tax value if the company exits in three years? Five years? What if it never exits?

Run scenarios. Stress-test the assumptions. Make sure the comp package is actually worth what you think it is.

2. Build a Cash Reserve for the Tax Bill

If you're taking a role with PPUs, start building a separate cash reserve now.

Assume you'll owe 47% on the payout. Set that money aside. Don't touch it.

When the liquidity event happens, you're not scrambling. You're ready.

3. Don't Let PPUs Replace a Diversified Wealth Strategy

PPUs are one line item in your comp. They're not your financial plan.

If you're earning $400,000 and banking on a $2 million PPU windfall in five years, you're not building wealth. You're gambling.

Build your super. Invest outside the company. Create cash flow that isn't tied to one exit event.

That's how you get to work-optional. Not by hoping. By planning.

4. Revisit the Structure When Circumstances Change

If the company raises at a higher valuation, your PPUs just became more valuable—and more concentrated.

If you get promoted and receive more PPUs, your tax exposure compounds.

Every 12 months, revisit the math. Make sure your strategy still holds.

Why Most Advisors Get This Wrong

Here's the uncomfortable truth: most financial advisors in Australia have never seen a PPU.

They've handled RSUs. Maybe options. But PPUs from a US tech company structured as a partnership interest? That's niche.

And if your advisor doesn't understand the tax treatment, they can't help you optimize it.

But here's the bigger problem: even if they've seen PPUs before, most generic advisors don't understand the tech professional's world.

They don't know what equity comp looks like at scale. They don't know how vesting schedules stack year after year. They don't know that your total comp can swing $200,000 depending on share price movements you can't control.

They're used to clients with salaries and dividends. Maybe a rental property. Not someone earning $450,000 with half of it in equity that vests across four years while they're deciding whether to jump to another company for a refresh grant.

I've had clients come to me after signing offers with PPU-heavy comp packages. Their previous advisor told them "it's just like RSUs."

It's not.

And by the time they realized that, they'd already built a financial plan on the wrong assumptions.

The Bigger Picture

PPUs are just one example of a broader issue I see constantly with tech professionals in Australia.

You're earning more than 95% of the population. You're getting comp packages that would make most people's heads spin.

But you're also dealing with financial complexity that most advisors aren't equipped to handle.

Equity comp structures from US companies. Tax treaties. Vesting schedules that span borders. Concentration risk that builds silently while you focus on shipping product.

And because you're time-poor and mentally fatigued from work, you assume someone else has thought this through for you.

They haven't.

The result? You're earning $500,000 a year and showing nothing for it. Lifestyle creeps up. Tax eats 47%. Super underperforms. And you're no closer to work-optional than you were three years ago.

That's the blind spot.

You don't know what you don't know. And by the time you figure it out, you've lost years—and hundreds of thousands of dollars.

What You Should Do Next

If you're considering a role with PPUs—or you've already accepted one—here's what I'd do:

Get clear on the tax treatment. Model the scenarios. Build a cash reserve. And make sure your overall wealth strategy isn't built on a single exit event that may never come.

Don't assume your equity comp will take care of itself.

It won't.

If you want to understand exactly how PPUs (or RSUs, or options, or bonuses) fit into a strategy that gets you to work-optional by 50, book a Financial Clarity Report.

We'll map your current position, identify the blind spots, and show you what's possible when you stop guessing and start planning.

No obligations. No sales pitch. Just clarity.

Because you didn't work this hard to hand half of it to the ATO—or worse, to build wealth on paper that never materializes.

Book your Financial Clarity Report here

— Mo Shouman

P.S. If you're already holding PPUs and wondering whether you're structured correctly, let's talk. The average client we work with unlocks $54,543 per year in additional wealth through smarter tax, super, and investment strategies. Most of that comes from fixing blind spots exactly like this one.